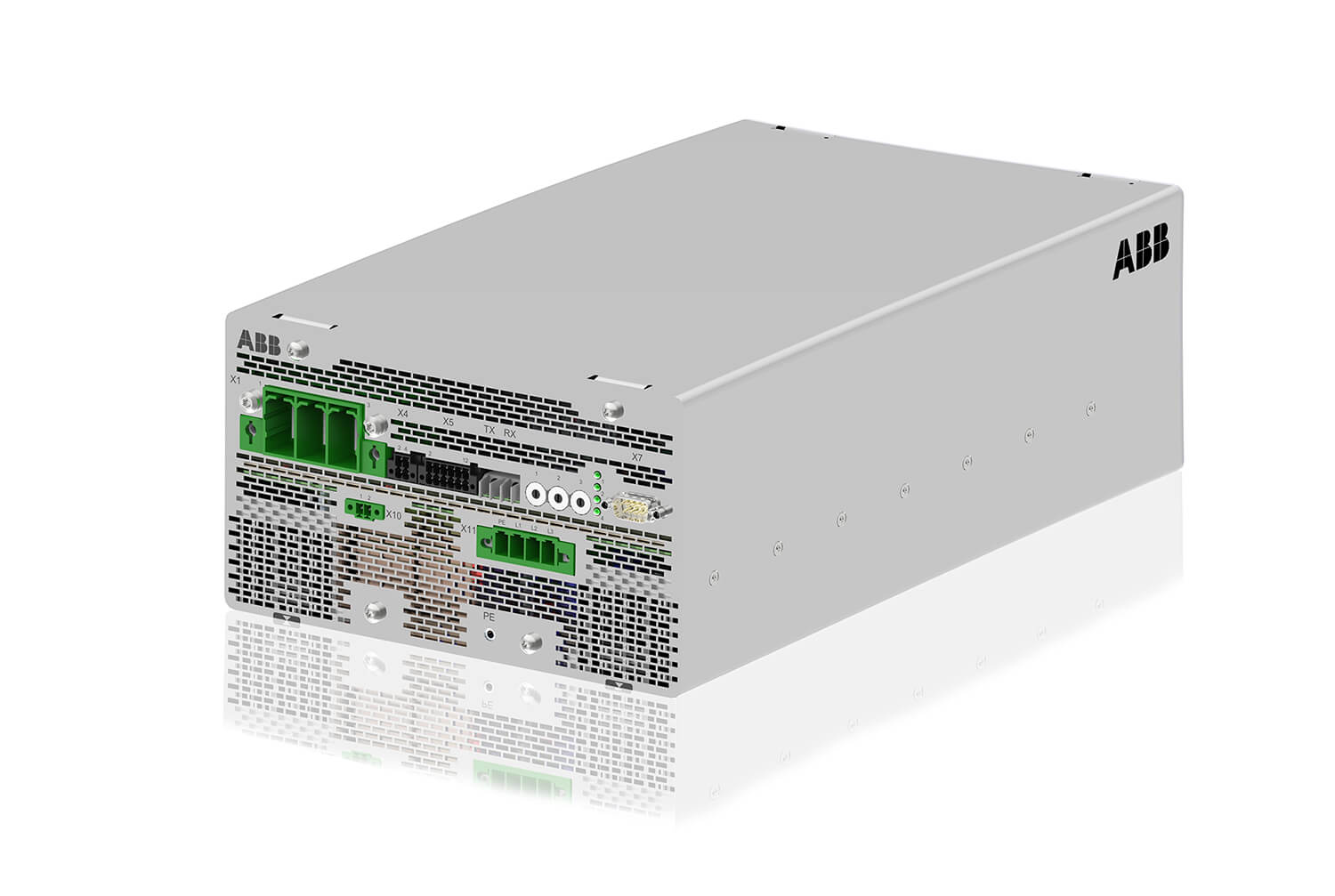

ABB is launching a next generation battery charger based on silicon carbide (SiC) power semiconductors for use in all rail applications. Train batteries provide power for critical systems such as control and lighting. The new compact battery charger of the series, BORDLINE® BC, complements ABB`s large stand-alone auxiliary converter product family and is compatible with all standard train battery voltages.

With a footprint of 360 x 220 mm – the size of a shoebox – it is about 10 times smaller and has a weight reduction of 80 percent compared to previous generations. The new device excels with a high power density of 1 kW per liter and per kg, an improvement from previous generations by a factor of 15.

Modern trains have varying requirements for power electronics components. In local transportation, such as trams, the components need to be as lightweight as possible to improve overall system energy efficiency. The need in long-distance and high-speed transportation is for compact and powerful, yet reliable devices.

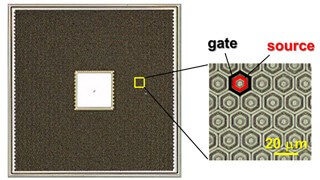

The BORDLINE BC battery charger employs ABB’s well proven modular platform design while incorporating SiC technology for the first time. SiC power semiconductor technology enables a power density and performance not possible with conventional silicon (Si) power semiconductors due to its conductivity characteristics. Mastering SiC technology translates into dramatically reduced size, weight, and cooling requirements, and increased system efficiency, all critical factors for rail operators.

“The new battery charger leverages all the benefits available from SiC and soft switching technologies to allow for a new performance level of power electronics in railway,” said Sami Atiya, president of ABB’s Discrete Automation and Motion division. “ABB has a long history of providing innovative and energy-efficient technologies to the rail industry and we will continue innovating for the transportation sector, a key growth area in our Next Level strategy.”

The new high-speed trains by Stadler operated by the Swiss Federal Railways (SBB) on the new transalpine Gotthard base tunnel route between Zurich and Milan will be equipped with this groundbreaking technology.

ABB (www.abb.com) is a leading global technology company in power and automation that enables utility, industry, and transport and infrastructure customers to improve their performance while lowering environmental impact. The ABB Group of companies operates in roughly 100 countries and employs about 135,000 people.

Technological background information:

SiC power semiconductor technology offers significant advantages over traditional silicon-based devices in power applications requiring low losses, high frequency switching and/or high temperature environments. For example, the dielectric strength voltage of SiC is about 10 times greater than that of Si. Low losses are critical to the performance ratio and SiC technology can reduce the power loss by up to a factor of five. High frequency switching can be increased from the conventional technology level with a range of 10 to 20 kHz by a factor of 10.