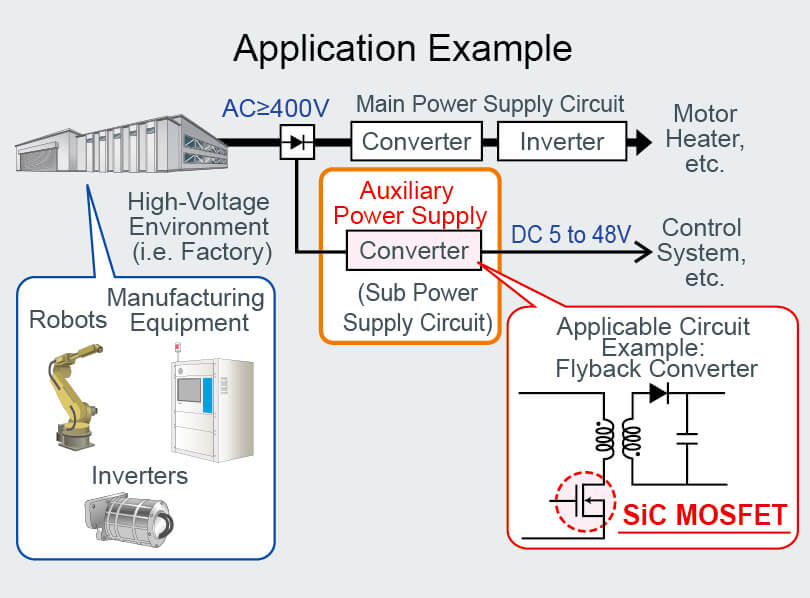

ROHM has recently announced the availability of a new 1700V SiC MOSFET optimized for industrial applications, including manufacturing equipment and high-voltage general-purpose inverters.

In recent years, the growing trend to conserve energy in all areas has increased the demand for energy-saving power semiconductors, particularly for applications in the industrial sector such as general-purpose inverters and manufacturing equipment. In the majority of auxiliary power supplies, which are used to provide drive voltages for power supply circuits, control ICs, and various supplementary systems, high breakdown (1000V+) silicon MOSFETs are normally utilized. However, these high-voltage MOSFETs suffer from large conduction loss (often leading to excessive heat generation), and present problems related to mounting area and the number of external components, making it difficult to reduce system size. In response, ROHM developed low-loss SiC MOSFETs and control ICs that maximize performance while contributing to end-product miniaturization.

The SCT2H12NZ provides the high breakdown voltage required for auxiliary power supplies in industrial equipment. Conduction loss is reduced by 8x over conventional silicon MOSFETs, contributing to greater energy efficiency. And combining with ROHM’s AC/DC converter control IC designed specifically for SiC MOSFET drive (BD7682FJ-LB) will make it possible to maximize performance and improve efficiency by up to 6%. This allows smaller peripheral components to be used, leading to increased miniaturization.

1. Optimized for auxiliary power supplies in industrial equipment

Compared to 1500V silicon MOSFETs used in auxiliary power supplies for industrial equipment, the SCT2H12NZ provides higher breakdown voltage (1700V) with 8x smaller ON resistance (1.15Ω). In addition, the compact TO-3PFM package maintains the creepage distance (distance measured along the surface of the insulating material) required by industrial equipment. ROHM is releasing a surface mount type (TO268-2L) that also provides adequate creepage distance.

2. Improved efficiency when combined with ROHM’s dedicated IC

Using this latest SiC MOSFET in combination with ROHM’s AC/DC converter control IC (BD7682FJ-LB) designed specifically for SiC MOSFET drive will make it possible to maximize performance and increase efficiency by up to 6%. At the same time heat generation will be reduced, minimizing thermal countermeasures and enabling the use of smaller components.

3. Simply evaluation by using ROHM’s evaluation board for SiC devices

As a comprehensive semiconductor manufacturer, ROHM offers a broad lineup of ICs optimized for use with a variety of SiC devices. ROHM is also launching evaluation boards and kits that make it possible to immediately begin evaluation and development. In addition to the BD7682FJ-LB-EVK-402, a gate drive board for evaluating ROHM’s full SiC module along with a snubber module are offered. More information can be found on ROHM’s dedicated support page.

Applications

Auxiliary power supplies for high voltage (i.e. 400VAC) industrial equipment such as factory automation (robots), solar and industrial inverters, and manufacturing/testing devices

| Part Number | Package | Polarity | VDSS | ID | PD (Tc=25ºC) |

RDS(on) VGS=18V |

QG VGS=18V |

|

|---|---|---|---|---|---|---|---|---|

| NEW | SCT2H12NZ | TO-3PFM | Nch | 1700V | 3.7A | 35W | 1.15Ω(typ.) | 14nC (typ.) |

| Under Development | SCT2H12NY | TO-268-2L (Surface Mount) |

4A | 44W | ||||

| Under Development | SCT2750NY | 5.9A | 57W | 0.75Ω(typ.) | 17nC (typ.) |