From March to May: Wrap-up of APEC and PCIM conferences

March to May is the most active period of the year for Power electronics. With the main events that are APEC and PCIM happening two months one from the other, there is a lot to do, a lot to plan and announce too. You might have been buried under tons of work and projects lately (Well, we were!). Don’t worry, PointThePower.com is here to summarize and analyze what happened, and it’s a lot!

Wide band gap field has been very active, and some other trends we announced (car maker entering the smart-grid market or the integration of intelligence in power stacks) have been a bit more confirmed.

Let’s see that in detail.

What’s new about Silicon Carbide

« Silicon Carbide is coming. » We know you have been hearing that for the last decade. So let’s pass the analysis and just go straight to the proofs:

We always said that SiC MOSFET would give its best at higher voltages. Hitachi and Mitsubishi Electric showcased their 1.7kV and 3.3kV full Silicon Carbide MOSFET. They are already filed testing these power modules on their trains in Japan. You could ride a (partially) Silicon Carbide powered trains. That is where SiC belongs, and it’s becoming real, at last.

Infineon has announced their Silicon Carbide MOSFET. It’s coming late, but it seems they did a good work. According to the presentation they gave at PCIM, they wanted to build a device that meets their requirements. They did not want to enter into a race of announcements. So the device is a Trench MOSFET – available at 1200V in samples from now, and in full production in 2017. You can basically replace chip-to-chip an IGBT with this MOSFET. It accepts the same inputs from the driver. But of course, you can get better performances using a specific power device driver. It starts sampling now but will be fully available by 2017.

Rohm also showcased a Trench SiC MOSFET, but for them it’s the third generation. The main improvement is about surge robustness which is now time higher. They recalled that they have a fully integrated supply-chain. The new devices are available at higher current (the technology was presented last year.). They now propose power modules up to 1200V/300A.

Littelfuse is investing more and more in partnership with Monolith Semiconductors to propose a full line of Silicon carbide devices and modules.

On the higher voltage side, Wolfspeed (formerly Cree power branch), Hitachi and Mitsubishi Electric make their way to higher voltages. The devices are not publicly available but tests are currently on-going. The main target for 1.7kV and 3.3kV Silicon Carbide MOSFETs are Rail traction inverters, Grid or Wind turbines.

What to expect for SiC in the next months:

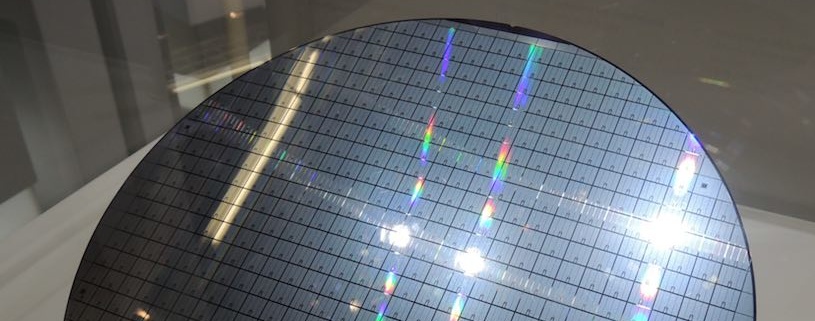

We will see higher voltage devices becoming available. With wafers becoming larger (production is moving to 6 in.), we also need to expect bigger volumes of production and a reduction of production costs, thus production price. High voltage devices (1.7kV and more) will be more and more visible. It does not mean that you will be able to use them yet, but you will see more and more papers, presentations, and maybe a few public announcements about their use. R&D and design engineer will be able to put their hands on some of them, which is still very difficult today.

What’s new in GaN:

Shindengen developed and showed a Power module with GaN devices from Transphorm. Most power module maker’s start to work on the developments of their product line. They just need to « bet on the right horse ».

ViSIC is proposing sampling of its 600V GaN devices. They claim to have the best figure of merit of the market to date. Mass production will start in 2016 too. They partnered with TSMC toward this objective.

ExaGaN found a local partner to test and qualify their GaN devices.

GaN IC: a necessity?

Navitas semiconductor came out of « stealth mode ». They presented their solution which is a GaN IC. You have the GaN power device and the driver on the same die. It’s not a mixed packaged (With Silicon and Gallium Nitride, but a single die IC). It’s a 650V device processed on 6 in. wafers and samples will be available by the beginning of 2017.

Texas Instruments also released their GaN IC at 600V/12A. Even though they do not attend PCIM yet. They did not disclose much information about the device. It seems to be similar to the product develop day Navitas semiconductor having the driver integrated and thus making life easier for designers facilitate device adoption. Infineon has the same strategy with their SiC MOSFET (which is, in theory, compatible with IGBT gate drives).

What to expect for GaN in the next months

We will probably see more and more announcement, and more and more products. Some power module maker will announce the availability of their GaN based power modules. Some GaN players will have to show what they have to stay in the race (Cambridge Electronics Inc. must be working on their manufacturing process to transfer it to mass production and Powdec must be preparing their device).

Other players will make all efforts to push their devices to the market.

We have a complete analysis of the situation available in our market report « Applications and Markets for GaN in Power Electronics .» Ask us for more info.

What is left for Silicon:

Toshiba announced the fifth version of the Super Junction MOSFET. It’s based on their « Deep trench » process using deep reactive ion etching to dig a hole and build the super junction structure in it. Super Junction MOSFET is the perfect competitor to GaN today, and high-end products that use SJ MOSFET are the most likely to move to Gallium Nitride HeMT tomorrow.

Infineon showed during PCIM, a 12 in. wafer with IGBTs processed on it. They will reduce again the cost of production of IGBTs by processing them on larger wafers. It makes the target harder to reach for competition. They also showed a double sided cooled modules for hybrid and electric cars. It’s very similar to what was used in 2008 Lexus LS600h by Toyota (and developed by Denso). The module has a DBC on top and another on the bottom side.

You can also note the partnership between Nissan and Eaton, to reuse EV batteries in home storage systems. This confirms our forecast of a main supply-chain trend: similarly to Alstom, Siemens and GE in high power, electric car makers will also become part of whole ‘consumer-level’ energy complex scheme that will make Smart-grid real.

Leave a Reply

Want to join the discussion?Feel free to contribute!